Types of Insurance Every FL Helicopter Should Carry

Flying a helicopter is fun and takes a lot of skill, but it’s also risky. That’s why it’s essential to have the right kinds of insurance policy coverage.

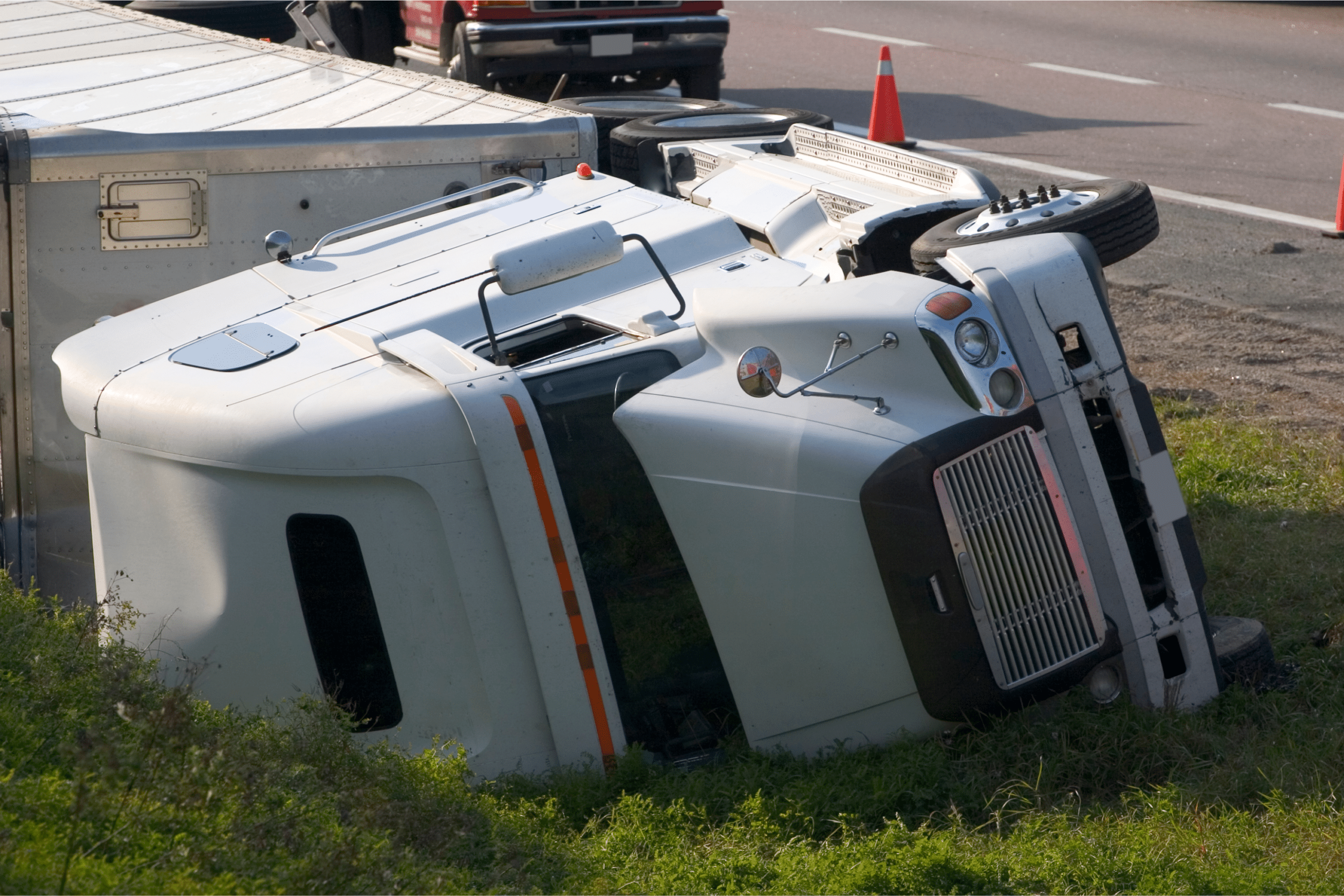

Take a helicopter that went down in Miami recently. The crash injured the pilot — luckily he wasn’t killed. This is the type of risk you take each time you strap into a helicopter, though, whether it’s for business or pleasure.

If you’re not sure what is needed when it comes to insurance for Florida helicopters, or what optional insurance policies best suit your need, then you’re not alone. Insurance is complex but it’s also necessary.

Understand the risks that riding in a helicopter poses, and read on to learn the different types of insurance every Florida helicopter pilot should carry.

Common Causes of Florida Helicopter Accidents

There are three major categories of causes when it comes to most helicopter accidents. Crashes and subsequent injuries are typically caused by an operational error, a mechanical malfunction, or an electrical malfunction. Let’s take a closer look at what each of those means.

Operational Error

Operational error is an issue of human error. These errors can impact the flight planning, training, maintenance, or conduct of the flight. This includes actions such as failing to operate the helicopter in accordance with its operational limitation, failing to properly plan the flight, and the improper training of maintenance and flight personnel.

Mechanical Malfunction

This is when a part of the helicopter fails to function as it should or fails altogether. This can happen at any point due to issues such as faulty manufacture, improper design, or improper use.

Electrical Malfunction

This occurs when an electrical source in the helicopter stops working. It can also happen when one of the components of the electrical system suffers a malfunction such as an electrical short, inadequate design, and inadequate monitoring during operation.

Insurance Policies FL Helicopter Pilots Should Consider

Helicopters are popular because they can take you places other forms of transportation simply cannot. If you run a business with your helicopter in a starring role, then it’s vital to have the right type of insurance to protect your assets as well as your investments.

General Liability Insurance

All businesses face risks, which is why all businesses must have insurance. One of the most common types of insurance you’ll read about is general liability insurance, a type of comprehensive policy business owners invest in.

General liability insurance covers items such as:

- Property damage

- Legal defense

- Bodily injury

- Medical payments

- Personal and advertising injury

It’s not required in Florida to have general liability insurance on an aircraft, but it’s a good idea to invest in it because of the risks associated with helicopters.

If you are ever sued and do not have general liability insurance, then you could end up facing the payment of hundreds of thousands of dollars in fees. When sufficient general liability insurance is carried, then it can help you to avoid financial ruin.

Commercial Property Insurance

Another type of insurance helicopter owner and operator should carry is commercial property insurance. This type of insurance helps to protect your investments in equipment, such as helicopters.

If there is a theft, a fire, or even a natural disaster and your insured property is covered, then your belongings will be replaced or repaired – including structural damage to any buildings or ground you have for your helicopters.

Hull Insurance

Hull insurance is sort of like car insurance, but for helicopters. Hull insurance is meant to help protect the owners of helicopters from damage or loss of the craft.

The only thing to be mindful of when it comes to hull insurance is that there are often policy limits attached that will pay out an agreed value. You should be careful never to under- or overvalue your craft.

Commercial Umbrella Insurance

A general liability policy will help to cover most claims, lawsuits, and accidents that occur, but some actions can be so devastating that they can exhaust the limits of a general liability policy. This is where commercial umbrella insurance comes into play.

This type of insurance protects you from out-of-pocket costs that can be associated with an accident or claim against you if they exceed your primary policy.

Workers’ Compensation Insurance

If you run a business associated with your helicopter and have employees, then you should get workers’ compensation insurance. This type of insurance can help to protect your employees if they injure themselves at work.

It covers lost wages, medical bills, and disability and death benefits that may be associated with an accident in the workplace.

Protecting what’s yours is important. After all, you invest your money in the things you own and should be covered in case of an accident or other catastrophic event. Always make sure your insurance provides the coverage you need.

About the Author:

Andrew Winston is a partner at the personal injury law firm of Winston Law. For over 20 years, he has successfully represented countless people in all kinds of personal injury cases, with a particular focus on child injury, legal malpractice, and premises liability. He has been recognized for excellence in the representation of injured clients by admission to the Million Dollar Advocates Forum and named one of America’s Top 100 High-Stakes Litigators. Mr. Winston is AV Preeminent Rated by the Martindale-Hubbell Law Directory, enjoys a 10.0 rating by AVVO as a Top Personal Injury Attorney, has been selected as a Florida “SuperLawyer” from 2011-2020 – an honor reserved for the top 5% of lawyers in the state – was voted to Florida Trend’s ”Legal Elite,” recognized by Expertise as one of the 20 Best Fort Lauderdale personal injury attorneys, named one of the Top 100 Lawyers in the Miami area for 2015-2017, and one of the Top 100 Lawyers in Florida for 2015-2017 and 2019.

My Florida Ambulance Got Into a Wreck — Can I Sue?

My Florida Ambulance Got Into a Wreck — Can I Sue?