The Winston Law Firm

WILL GO TO TRIAL IF NECESSARY

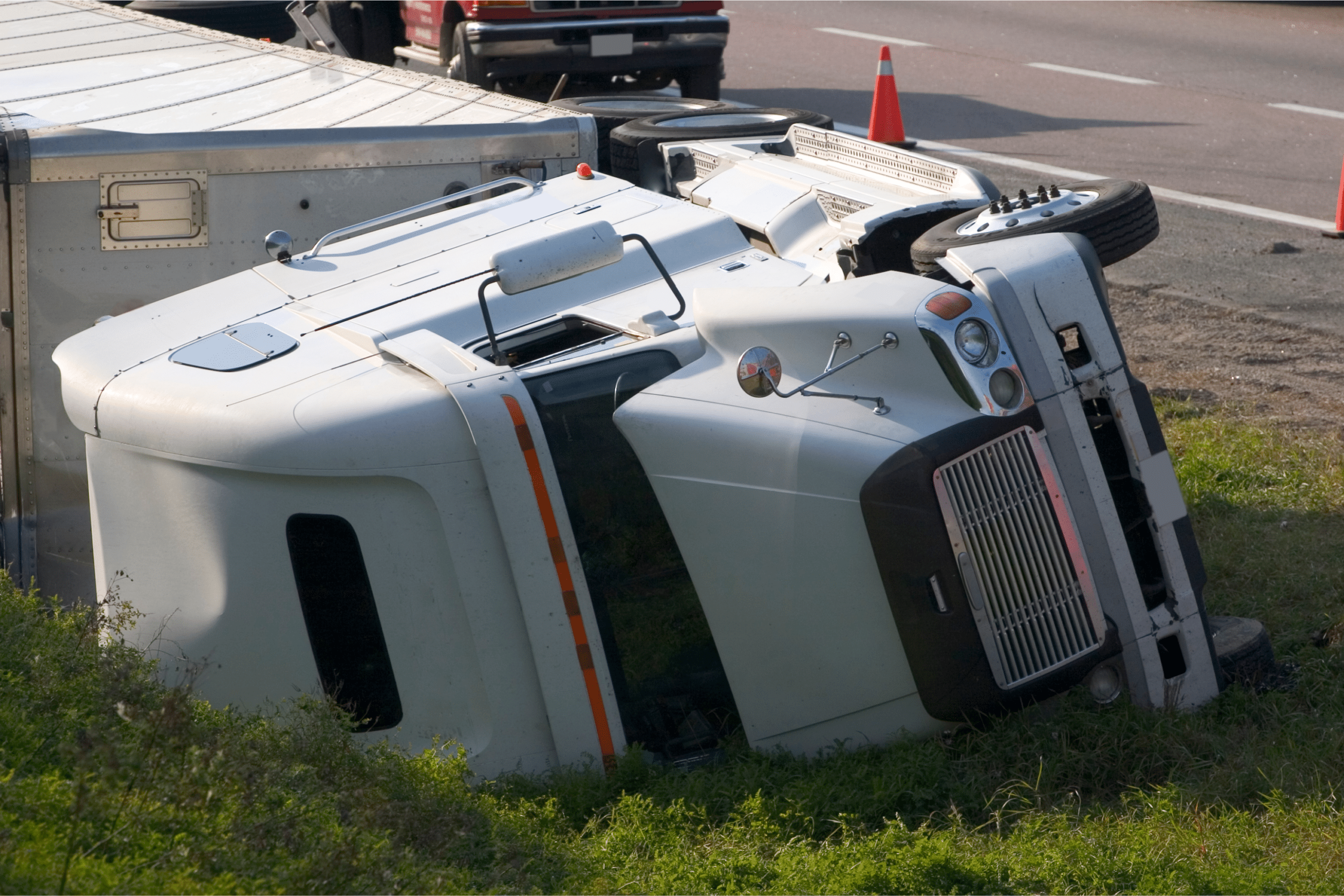

Many personal injury firms in Davie, Cooper City, Plantation, and surrounding areas will do everything possible to come to a settlement agreement before a case goes to court.

Why? Because they know that their lawyers do not have trial experience and are more likely to lose if they have to speak in front of a judge.

We will never take a lower settlement to get you out of court at Winston Law. Our lawyers are fantastic at finding ways to come to favorable settlements without going to trial because we know that many of our clients need money as soon as possible to help pay for medical bills and other related expenses. But if push comes to shove and the responsible parties only make lowball offers, we are more than happy to go to court to ensure you receive what you deserve.

When you are ready to fight back against those who have caused you harm, contact us to set up a free initial consultation. You will be able to sit down with one of our experienced professionals for no charge, go over the details of your case, and learn about potential strategies that might be taken to win compensation for you. All you have to do is email contact@winstonlaw.com, fill out our online case review form, or call us now: