How to Get the Most out of Your Florida Insurance Claim

When you file an insurance claim, you want the maximum payout for whatever damages you have suffered. In this post, we’re going to go over how to make the most of your insurance claim and when you need to seek legal assistance.

The Steps of a Florida Insurance Claim

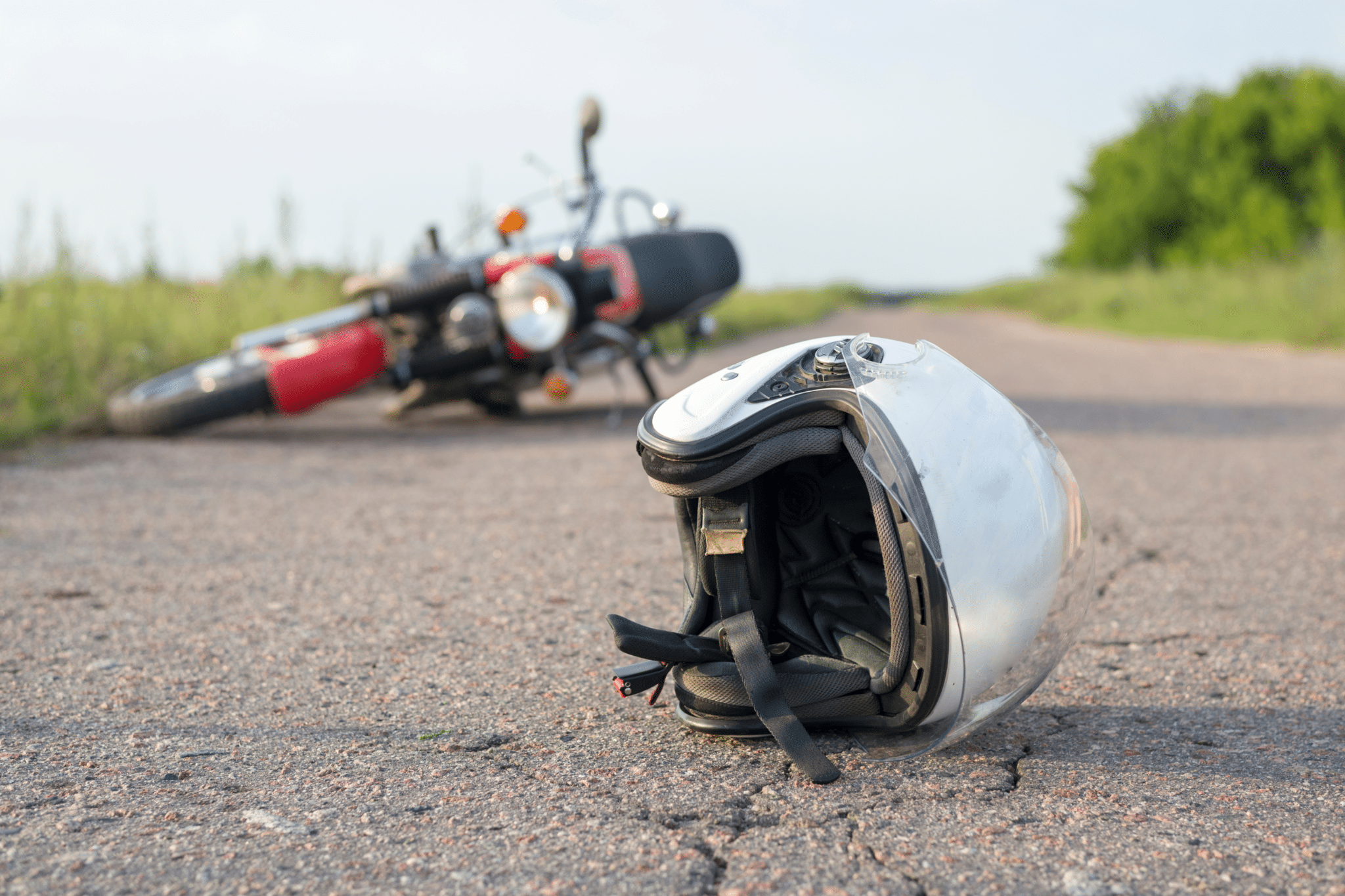

After you’ve experienced personal injury, a vehicle accident, property damage, or medical malpractice, you will file a claim with an insurance company. Here are the steps you must follow.

Call and present your claim. You must paint a clear and to-the-point picture of the damages you have experienced. Be careful not to admit any fault on your part in your communication with the adjuster. Doing so can keep you from getting paid. Insurance companies often try to avoid or minimize payout. Use your words wisely for maximum compensation.

Decide on your settlement figure. Your claim will state how much you believe you are entitled to receive under the insurance policy in question. You need to decide on a bare minimum amount that you would consider acceptable. Set your settlement figure above this bare minimum, and do not communicate it to the adjuster.

Evidence collection. The adjuster will collect evidence to assess the damages. This could consist of photos, documents, medical reports, police reports, or other evidence. The adjuster may ask you detailed questions about the accident. Make sure to answer each one politely and professionally, because resisting the adjuster’s questions could result in little or no compensation.

The adjuster’s estimate. Next, the adjuster will prepare an estimate for payout based on the evidence. He or she will call you with a low-ball figure. Don’t accept it right away. Countering the offer shows that you are willing to work with the adjuster but aren’t willing to settle for less than you deserve. You can counter the adjuster’s figure with a higher amount, but it cannot exceed your original number.

Response letter. If the adjuster’s offer is unreasonably low, ask the adjuster to explain their reasoning. You can respond to each of those reasons in another letter to the insurance company that demands a fair payout.

You need to stay focused on the facts in your letter. Mention key details like medical expenses, any disfigurement or long-term damage, and that the other party was negligent and totally at fault. If you have compelling evidence for emotional suffering, you can include it to strengthen your claim. For example, if you experienced severe post-traumatic stress disorder after a car crash, include that fact to boost your position.

Reservation of Rights Letter. In some cases, the insurance company will send you a reservation of rights letter. This means the insurance company will not pay you if the company’s investigation does not prove that you have coverage for the damages. This letter protects the insurance company from allegations that they aren’t addressing your claim.

Finalizing the settlement. In most cases, you will settle on a payout amount after a few phone calls. Once you reach an agreement, put it in writing. Include the date, settlement amount, and what the payout will cover.

When You Can’t Get a Fair Deal

If these negotiating tactics don’t get you the compensation you deserve, call an experienced Florida insurance claims attorney. Sometimes adjusters don’t treat clients fairly, and sometimes insurance companies take too long to respond.

These actions could mean that a lawsuit is your only recourse. A skilled injury lawyer will understand how to deal with your insurer to get you the compensation that you need and deserve. Reach out today for a free case evaluation.

About the Author:

Andrew Winston is a partner at the personal injury law firm of Winston Law. For over 20 years, he has successfully represented countless people in all kinds of personal injury cases, with a particular focus on child injury, legal malpractice, and premises liability. He has been recognized for excellence in the representation of injured clients by admission to the Million Dollar Advocates Forum, is AV Preeminent Rated by the Martindale-Hubbell Law Directory, enjoys a 10.0 rating by AVVO as a Top Personal Injury Attorney, has been selected as a Florida “SuperLawyer” from 2011-2017 – an honor reserved for the top 5% of lawyers in the state – and was voted to Florida Trend’s ”Legal Elite” and as one of the Top 100 Lawyers in Florida and one of the Top 100 Lawyers in the Miami area for 2015, 2016, and 2017.

Be Careful of Other Drivers in Florida This Christmas Season

Be Careful of Other Drivers in Florida This Christmas Season